How we work

How we work

High performance & results driven

Nova Patrimoine builds and follows-up on the discretionary portfolios of its clients, according to their specific investment profile.

We offer advisory asset management services based on this same principle.

Operating Strategy

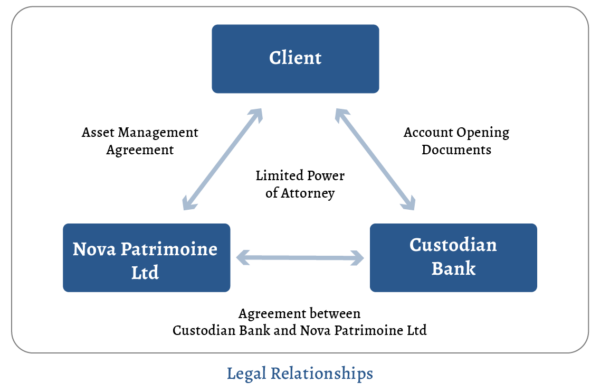

We like to meet with our clients and get to know them well, asking the right questions while listening to their specific needs and expectations. We can then define their portfolio and make an assessment of their asset base (family and financial situation, existing assets, commitments, objectives, risk tolerance, etc.). From here we build a portfolio, open a custodian bank account, sign a management agreement, deposit funds and transfer securities. We continually look for ways to make the ongoing process as seamless and simple as possible while keeping the lines of communication open between our client, Nova Patrimoine and the custodian bank.

Investment Strategy

There is much that is done to ensure that the risk profile of each client achieves the best risk-adjusted returns. Nova Patrimoine carries out a stringent allocation of assets based on the knowledge we receive from our strategic investment committee, which regularly carries out a macroeconomic market analysis based on information from our custodian banks and other independent experts. When it comes to choosing the actual investment vehicles, our tactical investment committee discusses the markets in depth and will then choose from direct investments (equities, bonds, commodities) as well as equity funds, bond funds, hedge funds, commodity funds and structured products.

Contact Us

Leave us a message and we will get back to you.

NAVIGATION

– Home

– About Us

– How We Work

SERVICES & SOLUTIONS

– Asset & Wealth Management

– Tax & Succession Planning

– Family Office

– Lifestyle Management

Leave us your info

and we will get back to you